SOME KEYS WORDS IN CRYPTOCURRENCY YOU DON'T

NEED TO MISS

1.) HISTORY OF BLOCKCHAIN NETWORK

The first distributed blockchain was then conceptualised by an anonymous person or group known as Satoshi Nakamoto in 2008 and implemented the following year as a core component of the digital currency bitcoin, where it serves as the public ledger for all transactions. Through the use of a peer-to-peer network and a distributed timestamping server, a blockchain database is managed autonomously. The use of the blockchain for bitcoin made it the first digital currency to solve the double spending problem without requiring a trusted administrator. The bitcoin design has been the inspiration for other applications.The words block and chain were used separately in Satoshi Nakamoto's original paper in October 2008.By 2014, "Blockchain 2.0" was a term referring to new applications of the distributed blockchain database. The Economist described one implementation of this second-generation programmable blockchain as coming with "a programming language that allows users to write more sophisticated smart contracts, thus creating invoices that pay themselves when a shipment arrives or share certificates which automatically send their owners dividends if profits reach a certain level. Blockchain 2.0 technologies go beyond transactions and enable "exchange of value without powerful intermediaries acting as arbiters of money and information". They are expected to enable excluded people to enter the global economy, enable the protection of privacy and people to "monetize their own information", and provide the capability to ensure creators are compensated for their intellectual property. Second-generation blockchain technology makes it possible to store an individual's "persistent digital ID and persona" and are providing an avenue to help solve the problem of social inequality by "[potentially changing] the way wealth is distributed". As of 2016, Blockchain 2.0 implementations continue to require an off-chain oracle to access any "external data or events based on time or market conditions [that need] to interact with the blockchain.A blockchain database consists of two kinds of records: transactions and blocks.Blocks hold batches of valid transactions that are hashed and encoded into a Merkle tree. Each block includes the hash of the prior block in the blockchain, linking the two. Variants of this format were used previously, for example in Git. The format is not by itself sufficient to qualify as a blockchain. The linked blocks form a chain.This iterative process confirms the integrity of the previous block, all the way back to the original genesis block.Some blockchains create a new block as frequently as every five seconds.As blockchains age they are said to grow in height.And when the term moved into wider use it was originally block chain,before becoming a single word, blockchain, by 2016. In August 2014, the bitcoin blockchain file size reached 20 gigabytes. In January 2015, the size had grown to almost 30 gigabytes, and from January 2016 to January 2017, the bitcoin blockchain grew from 50 gigabytes to 100 gigabytes in size.In 2016, the central securities depository of the Russian Federation (NSD) announced a pilot project based on the Nxt Blockchain 2.0 platform that would explore the use of blockchain-based automated voting systems.Various regulatory bodies in the music industry have started testing models that use blockchain technology for royalty collection and management of copyrights around the world. IBM opened a blockchain innovation research centre in Singapore in July 2016. A working group for the World Economic Forum met in November 2016 to discuss the development of governance models related to blockchain. According to Accenture, an application of the diffusion of innovations theory suggests that in 2016 blockchains attained a 13.5% adoption rate within financial services, therefore reaching the early adopters phase.In 2016, industry trade groups joined to create the Global Blockchain Forum, an initiative of the Chamber of Digital Commerce.Sometimes separate blocks can be produced concurrently, creating a temporary fork. In addition to a secure hash based history, any blockchain has a specified algorithm for scoring different versions of the history so that one with a higher value can be selected over others. Blocks not selected for inclusion in the chain are called orphan blocks.[36] Peers supporting the database have different versions of the history from time to time. They only keep the highest scoring version of the database known to them. Whenever a peer receives a higher scoring version (usually the old version with a single new block added) they extend or overwrite their own database and retransmit the improvement to their peers. There is never an absolute guarantee that any particular entry will remain in the best version of the history forever. Because blockchains are typically built to add the score of new blocks onto old blocks and because there are incentives to work only on extending with new blocks rather than overwriting old blocks, the probability of an entry becoming superseded goes down exponentially[38] as more blocks are built on top of it, eventually becoming very low

1.) what is blockchain

Firstly: A network of so-called computing “nodes” make up the blockchain. A blockchain is a decentralized and distributed digital ledger that is used to record transactions across many computers so that the record cannot be altered retroactively without the alteration of all subsequent blocks and the collusion of the network.

2.) what is cryptocurrency

A cryptocurrency is a medium of exchange like normal currencies such as USD, but designed for the purpose of exchanging digital information through a process made possible by certain principles of cryptography

The first work on a cryptographically secured chain of blocks was described in 1991 by Stuart Haber and W. Scott Stornetta. In 1992, Bayer, Haber and Stornetta incorporated. Merkle trees to the blockchain as an efficiency improvement to be able to collect several documents into one block.

When you purchase s The ome cryptocurrency, you are in fact buying some tech stock, a part of the blockchain and a piece of the network.

3.) what is cryptography

Cryptography is a way to keep messages and other data secret. Cryptography is the art of writing or solving ciphers. ... In the business world, cryptography refers to mathematically based encryption methods that keep data away from the prying eyes of criminals or enemy governments.

Cryptography is used to secure the transactions and to control the creation of new coins.

4.) transational properties

i.) Irreversible: After confirmation, a transaction can‘t be reversed. By nobody. And nobody means nobody. Not you, not your bank, not the president of the United States, not Satoshi, not your miner. Nobody. If you send money, you send it. Period. No one can help you, if you sent your funds to a scammer or if a hacker stole them from your computer. There is no safety net.

ii.) Pseudonymous: Neither transactions nor accounts are connected to real-world identities. You receive Bitcoins on so-called addresses, which are randomly seeming chains of around 30 characters. While it is usually possible to analyze the transaction flow, it is not necessarily possible to connect the real world identity of users with those addresses.

iii.) Fast and global: Transaction are propagated nearly instantly in the network and are confirmed in a couple of minutes. Since they happen in a global network of computers they are completely indifferent of your physical location. It doesn‘t matter if I send Bitcoin to my neighbour or to someone on the other side of the world.

iv.) Secure: Cryptocurrency funds are locked in a public key cryptography system. Only the owner of the private key can send cryptocurrency. Strong cryptography and the magic of big numbers makes it impossible to break this scheme. A Bitcoin address is more secure than Fort Knox.

v.) Permissionless: You don‘t have to ask anybody to use cryptocurrency. It‘s just a software that everybody can download for free. After you installed it, you can receive and send Bitcoins or other cryptocurrencies. No one can prevent you. There is no gatekeeper.

5.) what are the most popular crypto currency

- bitcoin (btc)

- ethereum (eth)

- litecoin (lct)

- dashcoin .

6.) who invented bitcoin

Satoshi Nakamoto

‘What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party’ – Satoshi Nakamoto, 2008.

For a cryptographically secured digital currency built on a system that requires no central authority, it is unsurprising that its creator has stayed in the shadows. In fact, this is one of the reasons for the success of bitcoin, and the other cryptocurrencies it has inspired since.

Satoshi Nakamoto is the pseudonym of one or more programmers that, in late 2008, began circulating a whitepaper, ‘Bitcoin: A Peer-to-Peer Electronic Cash System’, that outlined a vision to create a purely peer-to-peer version of electronic cash that would allow online payments to be sent directly from one party to another without going through a financial institution.

While there has been numerous individuals suspected of founding bitcoin (including PayPal founder and Tesla chief executive Elon Musk and a Japanese-American who just happened to be named Dorian Prentice Satoshi Nakomoto), the world is no nearer to discovering the creator’s true identity than it was ten years ago.

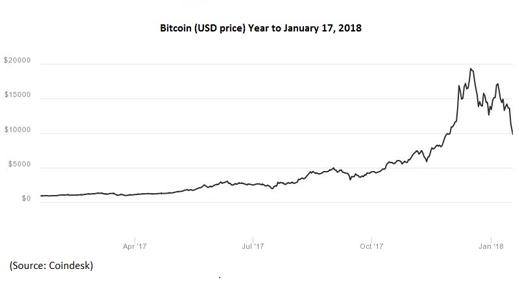

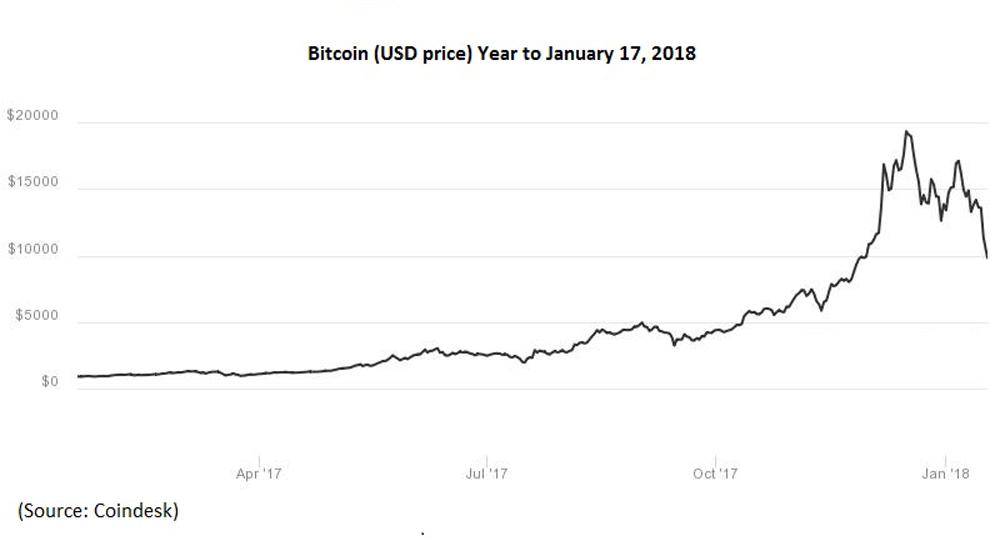

However, there are some known individuals that have been elemental in turning bitcoin from a low valued cryptocurrency more associated with money laundering and illicit drugs to one that has managed to soar to almost $20,000 in December 2017 and challenged the perception of a world accustomed to ‘fiat’ currencies and financial institutions.

Find out more about who owns bitcoin.

Hal Finney

As the first person to use bitcoin after Satoshi, Finney is seen as an instrumental architect of bitcoin and its foundations. He passed away in August 2014 having succumbed to amyotrophic lateral sclerosis, or ALS, which paralysed him in August 2009.

The computer scientist worked closely with the creator of Pretty Good Privacy (PGP), a digital data encryption program developed in the 1990s that would eventually become a key cog in the bitcoin machine. He was so intrigued when the bitcoin whitepaper was released several years later, that he became the first person besides Satoshi to run bitcoin, mining ‘block 70-something’, and was the recipient of the first bitcoin transaction after Satoshi sent 10 bitcoins to him as a test.

Although Finney conversed with Satoshi via email to help filter out initial bugs, he claimed he never discovered Satoshi’s identity, and had to deny that he was the mysterious founder on several occasions.

In a forum post in March 2013, Finney said the true identity of Satoshi was a mystery, but that he believed, when he was interacting with him, he was dealing with a ‘young man of Japanese ancestry who was very smart and sincere’.

Phil Zimmerman

Zimmerman was the man behind PGP, which he developed (with the help of Finney) years before bitcoin emerged, after recognising that cryptography ‘is about the right to privacy, freedom of speech, freedom of political association, freedom of the press, freedom from unreasonable search and seizure, freedom to be left alone,’ according to the University of Pittsburgh.

PGP was created when email was, as Zimmerman put it, ‘a novelty’ and not mainstream. PGP is used for signing, encrypting, and decrypting messages and files. With respect to cryptocurrency, PGP allows users to create a pair of keys – a ‘public’ key for encryption and a ‘private’ key for decryption. This is at the heart of the technology that cryptocurrencies are based on, known as blockchain, and is the reason why users can circumnavigate the middle-men like banks that manage traditional transactions in a secure manner.

Nick Szabo

The computer scientist has had to deny claims he is Satoshi for years, having been considered a likely candidate after creating what is widely seen as the precursor to bitcoin, ‘bit gold’. Bit gold was made in 1998 – a decade before the bitcoin whitepaper – and, in a nutshell, was a mechanism (which never quite took off) designed to facilitate a decentralised digital currency.

Looking at Szabo’s description of the bit gold protocol and why he was pursuing it, it is unsurprising he has and is still seen by many as the founder of bitcoin.

‘It would be very nice if there were a protocol whereby unforgivably costly bits could be created online with minimal dependence on trusted third parties, and then securely stored, transferred, and assayed with similar minimal trust. Bit gold.’

Craig Wright

Unlike those who have had to deny claims made by other people, Australian entrepreneur Wright surprised the world when he told the three media organisations he was Satoshi in May 2016. He provided ‘technical proof’ to the BBC by digitally signing messages using keys made in the early days of bitcoin, ones that were synched with the blocks used by Satoshi to send 10 bitcoins to Finney in January 2009.

Although he was backed by two figures from the Bitcoin Foundation (a non-profit aiming to standardise, protect and promote the use of bitcoin), he failed to follow-through on his promise to prove he possessed Satoshi's cryptographic keys by moving bitcoins from the first blocks ever mined by Satoshi.

In a rather undignified fall from grace, Wright later published a blog that said he ‘broke’ as he prepared to publish the proof, stating ‘I do not have the courage. I cannot’. Still, there are many in the community that believe his claim based on the other evidence, but the bottom line is that Wright has failed to undeniably prove he is Satoshi and win round the bitcoin buyers.

But why create something and not take the credit?

Firstly, as a truly independent system free from any central body, the fact it has no official owner or recognised creator beyond the pseudonym is quite fitting. The bitcoin community, therefore, makes decisions and shapes its future through consensus – arguably making bitcoin a truly democratic currency.

Secondly, although Satoshi has barely appeared since vanishing from the internet in 2011, when they had ‘moved on to other things’, it is likely Satoshi walked away with one of the largest wallets of bitcoin in existence to this date. While there have been estimates over the precise figure, it has been reported to be up to 1 million bitcoins, or 5% of all the bitcoin that will ever exist. With that much, Satoshi has the ability to heavily influence the market and anonymity would allow the founder, for example, to sell without sparking havoc amongst other bitcoin users.

To find out more about what moves the cryptocurrency's price, take a look at our 'how to trade bitcoin' guide.

Thirdly, with the legality of bitcoin thrown into doubt over its decade-long life on several occasions, Satoshi may have been keen to not be seen as the creator of something that is designed to operate outside of government control and previously used on sites like Silk Road.

Cryptocurrency: possession is ten tenths of the law

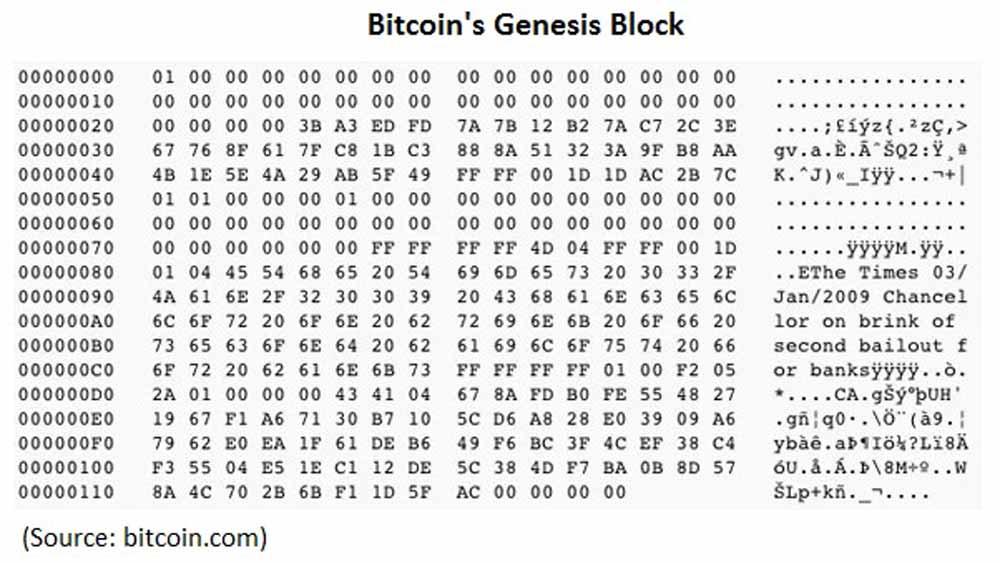

The real person (or persons) behind Satoshi could prove their identity by using the first PGP keys that control access to the bitcoins mined in the early days (no bitcoins have ever left Satoshi’s wallet). But some argue the founder would have to prove they have access to the ‘Genesis Block’ (the first block in the blockchain) to truly convince the community, or move bitcoin from that block.

Still, we know Satoshi is a world-class coder (which is the main argument for it being a group rather than an individual), speaks fluent English, and has disrupted the way the world understands money using a technology that will go well beyond bitcoin and the cryptocurrencies it has gone on to inspire.

x x